Ohio Business Gateway Sales Tax

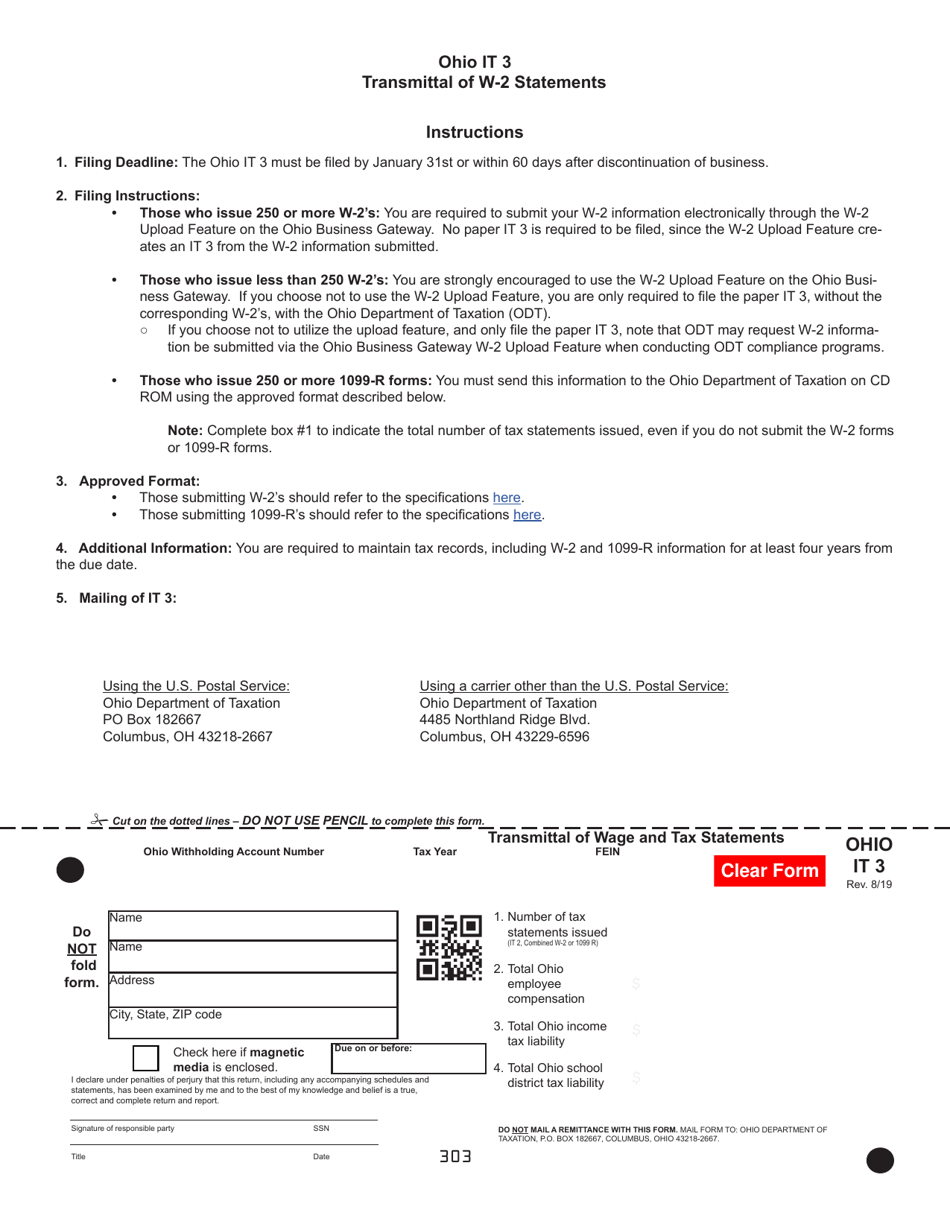

The business must also file any final W-2 statements for employees or 1099 forms for contractors where applicable. Gateway services offer Ohios businesses a time- and money-saving online filing and payment system that helps simplify business relationship with government agencies.

Businesses Department Of Taxation

Login with User Name and Password by.

Ohio business gateway sales tax. It provides tools that make it easier for any business owner to file and pay sales tax commercial activity tax employer withholding unemployment compensation contributions workers. You can apply or register for an Ohio sales tax permit by visiting the Ohio Business Gateway and following the instructions provided. Any withholding accounts should also be closed.

You should have received credentials to access your Ohio Business Gateway account when you applied for your Ohio sales tax license. The following Gateway Taxation applications will be under maintenance and unavailable on Saturday 7172021 between 530 AM to 1200 PM. The Gateway also partners with local governments to enable businesses to file and pay selected Ohio municipal income taxes.

Beginning with the 2018 tax year taxpayers have the option to file a single multijurisdictional municipal net profit tax return in Ohio through the Ohio Business Gateway the Gateway. Simply click the Upload Document to Ohio Department of Taxation option from your Dashboard to start the process. The Ohio Business Gateway is a nationally-recognized collaborative initiative of state and local government agencies and an important part of Ohios digital government strategy.

Sales tax returns can be filed through the Ohio Business Gateway and the frequency of your filing will be determined during the application process. The sales tax rate in Ohio is 575. We apologize for any inconvenience this may cause.

If a seller determines that they should be collecting and remitting sales tax to Ohio they must apply for a sales tax permit. Ohio knows that filing a sales tax return can be hard so they provide resources to business owners to help teach you how to file. TeleFile is available for vendors who have a regular county vendors license license number which begins with 01 88 and are filing for a single county.

The Ohio Business Gateway allows all sales and use tax returns to be filed and paid electronically. If the business had or anticipated at least 150000 in taxable gross receipts during its final tax year it may need to file and pay Ohios Commercial Activity Tax. Ohio does offer an old school paper based form PDF you can print and mail in but this is going to be a slower setup six weeks and with greater possibility for errors.

You can look up your local sales tax rate with TaxJars Sales Tax Calculator. To get your Vendors License which authorizes you to collect sales tax you can either apply online via the Ohio Business Gateway website or in-person at your local county auditors office. Weve done the work for you and compiled a list of helpful links videos and resources to make filing your first sales tax return easier.

Gateway services offer Ohios businesses a time- and money-saving online filing and payment system that helps simplify business relationship with government agencies. A customer living in Toledo Ohio finds Steves eBay page and purchases a 350 pair of headphones. Ohios one-stop online shop for business tax filing is designed to streamline the relationship between commerce and government.

If you have more than one location in Ohio then you would base the sales tax rate you charge on the point of origin of your sale. The Online Notice Response Service area allows you to securely respond to most notices received from the Ohio Department of Taxation or the Departments request for additional information including forms through the Gateway. Collect sales tax at the tax rate where your business is located.

State Local Tax. Call the Ohio Business Gateway Electronic Filing Help Desk at 866 OHIO-GOV 866-644-6468 if you need assistance using the online application system. Previously taxpayers were required to file a separate net profit tax return in each municipality in which they maintained a taxable presence.

Municipal Net Profit Tax Replacement Tire Fee Other Tobacco Products Tax Motor Fuel Tax Cigarette Tax Master Settlement Agreement Wireless 911 Petroleum Activity Tax International Fuel Tax Agreement Financial Institutions Tax Severance Tax Sales. At a total sales tax rate of 725 the total cost is 37538 2538 sales tax. You can process your required sales tax filings and payments online using the official Ohio Business Gateway website which can be found here.

I have examined the information herein provided electronically in connection with the use of the Ohio Business Gateway to file the taxpayers municipal income tax return. Passwords are case sensitive. When calculating the sales tax for this purchase Steve applies the 575 state tax rate for Ohio plus 15 for Montgomery county.

To the best of my knowledge and belief the information provided is true correct and sufficient for the electronic transmission of a complete municipal income tax return. The Ohio Business Gateway applications will be unavailable on Thursday August 26 2021 from 530PM to approximately 630PM Eastern Time for routine maintenance and updates. Ohio Sales Tax Permit.

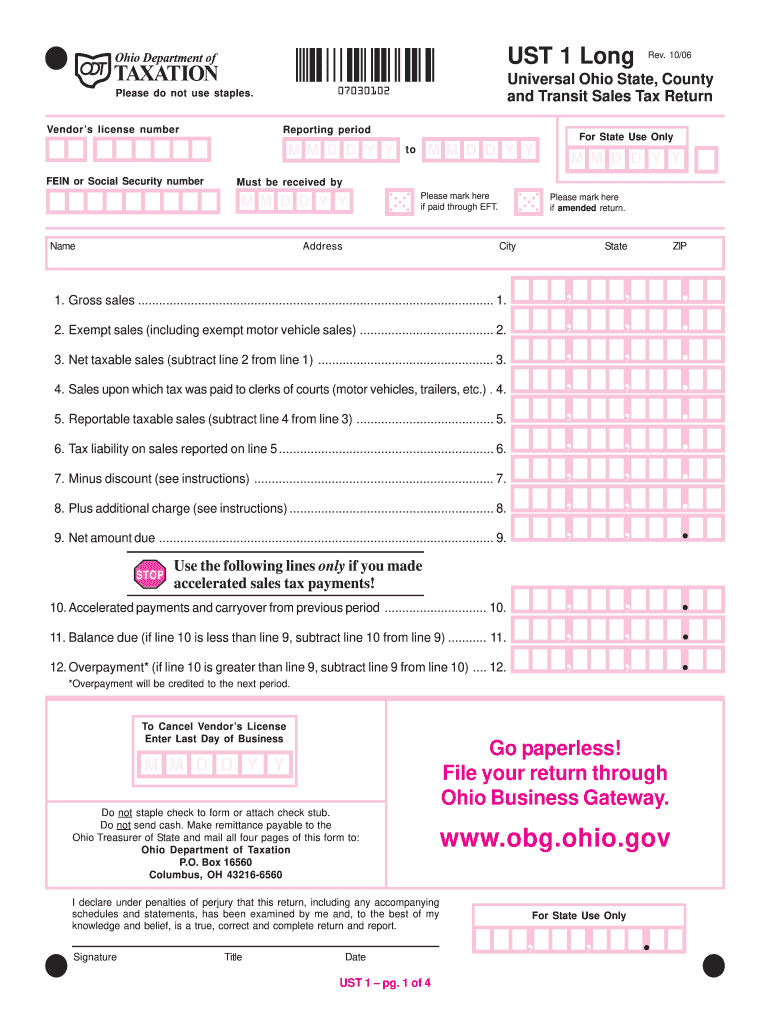

Ohio Ust Sales Tax Fill Online Printable Fillable Blank Pdffiller

Https Loginee Com State Of Ohio Business Gateway

Useful Important Links Sbdc Small Business Development Center Akron Ohio Sbdc Small Business Development Center Akron Ohio

Oh I Received A Sales Tax Delinquency Penalty For Over 3 000 For A Business That I Closed 18 Months Ago I Don T Understand Why This Happened And Could Really Use Some Help

Form It3 Download Fillable Pdf Or Fill Online Transmittal Of Wage And Tax Statements Ohio Templateroller

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Sales And Use Tax Electronic Filing Department Of Taxation

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Ohio Tax Gateway Ohio Business Gateway Sales Tax

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Sales And Use Tax Electronic Filing Department Of Taxation

Https Loginee Com State Of Ohio Business Gateway

Oh I Received A Sales Tax Delinquency Penalty For Over 3 000 For A Business That I Closed 18 Months Ago I Don T Understand Why This Happened And Could Really Use Some Help

Ohio Business Gateway Ohio Gov Official Website Of The State Of Ohio

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Ohio Business Gateway Ohio Gov Official Website Of The State Of Ohio

Posting Komentar untuk "Ohio Business Gateway Sales Tax"