Ohio Business Gateway Income Tax

Commercial Activity Tax CAT Employer Withholding. Please remember that you may be subject to penalties interest and other fees imposed by the Ohio Department of Taxation for late filing nonpayment underpayment or late payment of your tax liability.

Ohio Business Gateway Ohio Gov Official Website Of The State Of Ohio

Municipal Income Tax for Electric Light Companies and Telephone Companies.

Ohio business gateway income tax. Ohio business gateway tax forms. Yes Ohio I-File and Ohio ePayments will be available for you to use even if you are late in filing your Ohio individual income tax return or Ohio school district income tax return. Simply click the Upload Document to Ohio Department of Taxation option from your Dashboard to start the process.

To the best of my knowledge and belief the information provided is true correct and sufficient for the electronic transmission of a complete municipal income tax return. Gateway services offer Ohios businesses a time- and money-saving online filing and payment system that helps simplify business relationship with government agencies. Save time and money by filing taxes and other transactions with the State of Ohio online.

This registration will notify us that your business will now be filing via ACH credit and potentially submitting bulk forms to process using preapproved software vendors. Register for Taxes through the Ohio Business Gateway or by. That was due May 10 2012 and to make the minimum tax payment for calendar year 2013.

A 50 Penalty of unpaidlate employee withholding tax will apply plus interest. Failure to file this return and make payment of the tax due could result in a late filing penalty of up to 50 or 10 of the tax due whichever is greater plus an additional late payment penalty of up to 15 of the tax due. The Gateway also partners with local governments to enable businesses to file and pay selected Ohio municipal income taxes.

Ohio business gateway cat tax. I have examined the information herein provided electronically in connection with the use of the Ohio Business Gateway to file the taxpayers municipal income tax return. Financial Institutions Tax FIT Gross Casino Revenue Tax.

If your combined annual gross receipts exceed 100000000 but less than or equal to 200000000. By selecting Continue you will create a brand new account in the Ohio Business Gateway which only should be done if you have never accessed the Gateway in the past. Ohios one-stop online shop for business tax filing is designed to streamline the relationship between commerce and government.

File your taxes make a payment check your refund status view payment history or send RITA a secure message. Get And Sign Ohio Commercial Activity Tax Return Form. If you have used the previous Gateway shown below but this is your first time visiting the modernized Gateway click the Cancel button and enter the username and password you have always used to access the Gateway to get started.

If you are a business that uses the software of a RITA approved software vendors click the link below to access the application to register. Please do not use Authority TaxConnect for these types of payments. Individual income will be taxed marginally with rates between 19 and 49 percent.

Businesses That Must Pay the Corporate Income Tax The majority of Ohio business entities must pay the Ohio corporate income tax on their business earnings. File Upload Express Data Entry - Upload county sales tax data or use tax from a file then key remainder of return. It provides tools that make it easier for any business owner to file and pay sales tax commercial activity tax employer withholding unemployment compensation contributions workers compensation premiums and municipal income taxes for nearly 500 cities and villages.

Ohio What Is My Login And Passcode Taxjar Support. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Payments for the first quarter of 2020 will be due April 30.

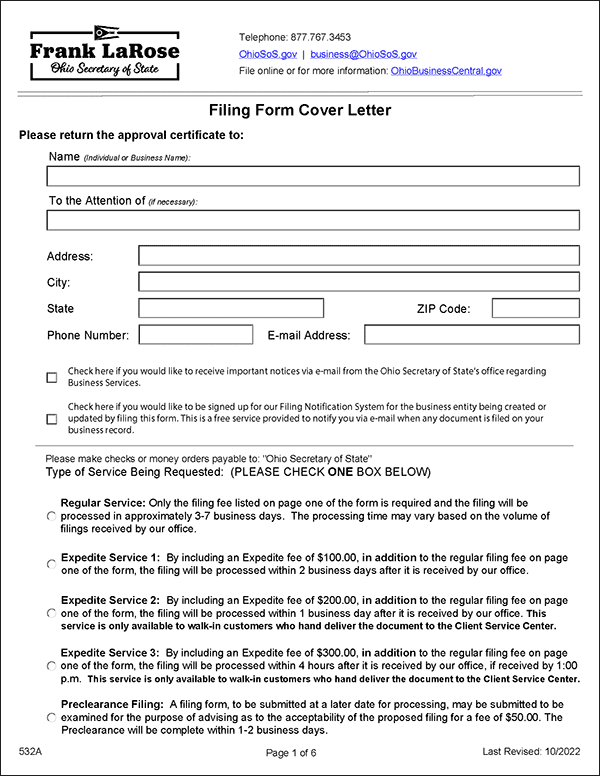

Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as. Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of taxes and other transactions including sales and use tax employer withholding commercial activity tax unclaimed funds and unemployment compensation tax. The Finder - This handy tool allows business owners to look up local income tax and sales tax.

Ohio Business Gateway E-File and E-Pay. Payroll services and employers should use the Ohio Business Gateway or ACH Addenda to pay withholding taxes. View options to manage your Business account online at MyAccount.

The Ohio Business Gateway Electronic Filing also partners with local governments to enable businesses to file and pay selected Ohio municipal income taxes. The Ohio Business Gateway provides businesses with access to electronic filing of selected municipal tax returns and to electronic payment of municipal income tax net profits and withholding. Employers with questions can call 614 466-2319.

A businesss net income usually is not taxed in Ohio. Annual Withholding Reconciliations are due on or before February 28 of each year. You can also access the service at taxohiogov - Online Notice Response Service utilizing your same Gateway Username and Password.

By going to the Municipal Income Tax Agencies and Administrators section the following transactions may be. Withholding payments can be made electronically through the Ohio Business Gateway.

Https Loginee Com State Of Ohio Business Gateway

Https Sidneyoh Com Documentcenter View 1828 2021 Employer Withholding Information Pdf

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Ohio Business Gateway Users Struggle With Rollout Of New System Business The Columbus Dispatch Columbus Oh

Http Www Tax Ohio Gov Portals 0 Online Services Ohiobusinessgatewaypresentation Pdf

Llc Ohio How To Start An Llc In Ohio Truic

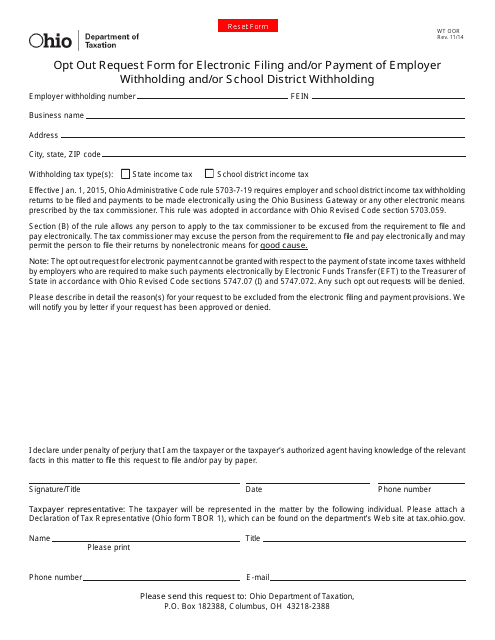

Form Wt Oor Download Fillable Pdf Or Fill Online Opt Out Request Form For Electronic Filing And Or Payment Of Employer Withholding And Or School District Withholding Ohio Templateroller

Https Loginee Com State Of Ohio Business Gateway

Https Tax Ohio Gov Portals 0 Excise Cigarettes Electronic 20filing 20manuals Filing 20cig58 20 20ohio 20cigarette 20tax 20return 20 20in 20state 3 Pdf

Ohio Business Gateway Users Struggle With Rollout Of New System Business The Columbus Dispatch Columbus Oh

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Ohio Business Gateway Ohio Gov Official Website Of The State Of Ohio

Businesses Department Of Taxation

Sales And Use Tax Electronic Filing Department Of Taxation

Ohio Department Of Taxation Posts Facebook

Sales And Use Tax Electronic Filing Department Of Taxation

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Posting Komentar untuk "Ohio Business Gateway Income Tax"